This is the first ngoLAW Brief of 2025, after a long hiatus.

We have not stopped writing, but have just not managed to get it out to you. A couple of (very kindly worded) emails from subscribers asking about when there would be another Brief have prompted action to get this one out and we aim to send out a few more in 2025, to make up for lost time, so hold onto your hats.

This Brief deals with the hot topic of the moment, which is the adaptation by government departments to the digital age, with online facilities aiming to streamline applications and registrations, and make maintenance and compliance simper and faster.

ALL SYSTEMS GO (OR NOT) :

In the ongoing process to escape grey-listing of South Africa by the Financial Action Task Force (FATF), government departments are generally upgrading, modernising and automating their systems, going electronic and online.

CIPC and SARS are ahead of the pack – Ongoing updates to their (already in working order) systems continue apace, with constant adjustments required by those who use them.

Trailing in the rear (or at the very back of the peloton) is the Master of the High Court, which has an online system for reporting beneficial ownership (but only, so far, available for trusts registered after 2016 and some in 2015). The uploading and systematising in their corner (already under-resourced and thinly staffed) is not expected to be finished any time soon.

The good news is that co-operation between all of these departments is at an unprecedented level (driven by the ill-wind of FATF) and there is work going on to close the gaps and synchronise systems.

NPO ONLINE APPLICATIONS LAUNCHED

DSD (Department of Social Development) has also been upgrading its NPO registration and reporting system and going entirely online, with the initial promised launch date of the end of March 2025 and then actual launch date on pushed out to 1 September 2025.

This is an extract from the DSD mailer:

“…The new system will be introduced in three (3) phases, the first phase will take effect from 1 September 2025 for the application of new NPO registrations only, whilst the second phase will be introduced on 1 October 2025, and the third phase will be introduced on 19 October 2025.

… Phase two will be implemented on October 1, 2025. This phase will allow the submission of annual reports, changes to the constitution, updates to organizational details, printing compliance letters, and accessing the education and awareness library.

Finally, phase three will be introduced on October 19, 2025. This phase will include the launch of a mobile App that enables NPOs to access registration and compliance services from the comfort of their homes, eliminating transportation costs to visit departmental offices. NPOs will receive guidance on how to access and use the App.”

So, far, as always with these systems, there have been some technical teething problems. There are also some fundamental design errors including:

- A drop-down box to choose from a (limited list) of objects; and

- A statement that the system ‘automatically generates a constitution’

These issues indicate a lack of understanding by the designers of the system of:

- The importance of an authentic and accurate statement of objects. The ‘main object’ of an organisation is its statement of its unique and individual approach to its chosen field of work and it sets the boundaries within which that organisation will work;

- The fact that only voluntary associations have constitutions; and

- The right of freedom of association, which allows those who found non-profits to choose the appropriate legal entity for the founding cohort, and then draft a founding and governing document which is useful, accurate, clear and unique to that organisation.

At the time of sending out this brief, there was also a practical issue with DSD disabling the ability to receive attachments not only for the email address for new applications (which makes sense) but also for the email addresses used for NPO updates and reports. We have sent up a flare on it, and I am sure DSD will have received complaints from many others, too.

When it comes to the launching of the online reporting, we anticipate issues with historical gaps in their records, primarily of email addresses of all of the board members of the organisation. These may have been captured at registration but:

- the NPO reporting regime, in which changes in board members must be recorded, has not required that email addresses for new board members be captured; and

- there are community-based organisations whose board members do not have email addresses.

We are also concerned about whether the new reporting system will contain the historical record of past NPO reports lodged and acknowledged. It would be wonderful to be pleasantly surprised on this!

NLC APPLICATIONS

The new and vigorous entry into the race is the National Lotteries Commission (NLC) which is making a concerted and rapid effort to shake off its terrible reputation and build ramparts against further pillaging of its coffers, by building an online system which creates an online profile for each organisation, requires extensive details and cross-checks and verifies details with other government systems in the background (Home Affairs, UPC, Central Supplier Database, and DSD).

It is this last aspect that was creating immense difficulties for organisations applying for funding (and there are suddenly many more of them than before, with USAID and PEPFAR funding swept out from under us (through the illegal, unconstitutional and contract-breaching actions of Trump) and EU funding on the decline as public spending re-aligns in that region.)

The NLC also governs applications to register for and run Society Lotteries, and we can report from ngoLAW that a recent application which we have dealt with for a client was handled swiftly, and with clear and helpful assistance at every step of the process.

CIPC UPDATE AND ISSUES

The new Companies Act is a power for good in the new legal structure options, flexibility and reporting and transparency measures it has introduced. And the CIPC has online systems which are clear, navigable (mostly), reliable, efficient and which have created speedy, accessible and secure mechanisms for business and nonprofit entities to be registered and updated.

- A new (standard form) NPC can be registered online in a matter of hours;

- Director changes are processed within 24 hours;

- Director and other changes have incorporated security protocols such as OTPs being sent to all affected by changes;

- Amended founding documents are registered within 4-6 days;

- Name reservations take less than 24 hours;

- The system requires all director details to be updated, building better public credibility and transparency;

- Online search facilities make the registered details of companies and their directors immediately accessible;

- ‘Back office’ links to Home Affairs systems allow for verification and pre-population of forms (though dependency on these systems routinely causes delays for CIPC processes);

- Those who serve as directors of companies are required to take responsibility for their own CIPC profiles, building engagement with and understanding of the systems;

- The annual reporting requirement provides deadlines and impetus for companies to keep proper records, adhere to reporting standards and stay current with administrative and governance matters;

- These same annual reporting requirements allow CIPC to clear from its system the ‘debris’ of failed or discarded companies, as deregistration follows non-compliance;

- The CIPC annual compliance checklist filing requirement (if understood and engaged with by the board itself) keeps matters of adherence to the law ‘on the radar’ and current.

The building, rolling out and integration of systems has not been without issues, but, even with these, the CIPC system we have today is a giant leap forward and, on the whole, effective, useful and user-friendly. (And, with each advance, it leaves the dusty and disorganised Master’s office further behind, clinging doggedly to outdated protocols and searching endlessly for lost files).

Like most systems, the CIPC systems have been built primarily to service business and its needs. And this is to be expected, as business is the main CIPC client and having an efficient and supported economy would be one of the main aims of the Department of Trade and Industry under which CIPC falls.

However, the non-profit sector also plays a major role in the functioning of our society and our economy, and needs to be properly served by the CIPC. Some current difficulties which are being experienced by NPCs include:

- A lack of understanding of the largely voluntary and independent nature of NPC boards. (CIPC is, at the moment, insisting that at least one director is recorded as ‘executive’ even if there are no executive directors on the board and the MOI or organisation culture prohibit or discourage executives from serving on the board);

- For ‘beneficial ownership’ filing, the CIPC fields require that each ‘beneficial owner’ is allocated a percentage of the ‘voting rights’ as though they were all shareholders. If it is a no-members NPC with five directors, then it is easy enough to allocate each director 20%. But in a with-members NPC, we report on the board and the members. The directors exercise oversight of ongoing management. The members appoint the directors. Each group has their own sphere of power and responsibility. And if there are five directors and 15 members, it makes no sense to ‘give’ each of them 5%, as the directors have more power on an ongoing basis, but the members greater ultimate power. The system should either remove the percentage requirement for NPCs or allow the percentage of each group to be separately added.

A NOTE ON NPC AFS AND ANNUAL RETURNS TO CIPC

Each year, all registered companies, including NPCs, must file their ‘annual return’ which includes an annual fee based upon ‘turnover’. Now, ‘turnover’ is routinely interpreted to mean ‘total sales’ so, for most NPCs, this number is low and the fee to be paid should be a minimal R100 a year (R150 if you file late) or, if the turnover is between R1 000 000 and R10 000 000, R450 a year (R600 if you pay late.)

Regulation 164(4) to the Companies Act defines ‘turnover’ as follows:

4) At any particular time, the annual turnover of(a) a company …. is the gross revenue of that company from income in, into or from the Republic, arising from the following transactions or events, as recorded on the company’s most recent annual financial statements:

(i) the sale of goods;

(ii) the rendering of services; or

(iii) the use by other persons of the company’s assets yielding interest, royalties or dividends ….

Based on these Regulations (and the IFRS for SMEs accounting standard, which most NPCs use), it is clear that most non-profits will pay the minimum annual return fee, as their ‘turnover’ will be limited to any income from sales of goods or services, interest earned on money in the bank, or interest and dividends earned on other investments.

To allow proper calculation of the annual return (and, indeed, of tax which might be due) it is important that the financial systems and records of the company distinguish between different types of funds received, and that these are accurately identified in the Annual Financial Statement of the company:

- Donations, grants bequests and other amounts which are ‘fund raised” should be grouped together;

- Sales income (from goods or services) should be on a separate line; and

- Interest and dividends should be clustered together.

We often find that there is no such distinction made in the Annual Financial Statements of our clients, or that the categories of funds received are incorrectly labelled. Quite often donations are just called ‘Sales’. Which they are not. Though compilers of Annual Financial Statements and those who review or audit them should be aware of the importance of these classifications and ask questions to check they are correct, it is usually the actual financial records and the ‘codes’ assigned when the systems are set up, that are to blame for the misidentification of funds. Those who compile, review or audit do so based on the records and materials provided to them, so these need to be set up correctly.

The misidentification of income sources has consequences for the annual return classification but also, importantly, for calculation of tax. For instance:

- For a non-profit which does not (or not yet) have tax exempt status, it is important to correctly identify donations and grants received as these fall outside of ‘gross income’ as defined in the Income Tax Act, and so are not taxable;

- For an organisation which has PBO or one of the other ‘partial’ exempt statuses, one must distinguish ‘Sales’ income (which may be taxable trading income) from donations, interest and other non-taxable funds;

- The obligation to register as a VAT vendor (and charge VAT to any customers) arises when you make ‘supplies’ of over R1 000 000 in a year. If donations are incorrectly classified as ‘Sales’, then it could seem that you need to register as a VAT vendor, when you do not.

As ever, proper planning and preparation and attention to these (yes, boring for most of us) details are really important.

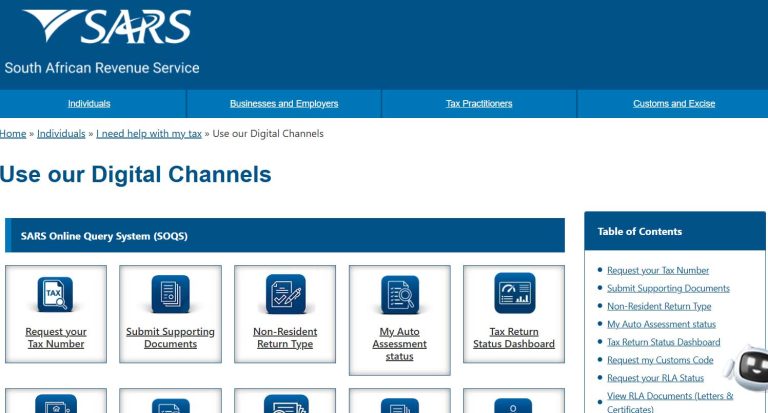

COMING VERY SOON: SARS ONLINE APPLICATIONS AND UPLOADS

The newly launched SARS Online Query System allows taxpayers to lodge various queries online (instead of going into branches) and Tax Exemption Unit at SARS is already using and testing the system with plans to roll it out to allow the uploading of documents in connection with exemption applications and a exemption updates. We will be early adopters, and are communicating our initial feedback to the TEU. Watch this space for more details as it comes into use.

Keep the questions coming and send us suggestions for future topics – visit our website, hit the ‘contact’ tab, and enter your question into the ‘Contact Form’ space provided.

Aluta continua

Nicole, Bandile, Janice, Chelsea, Lisa, Alison, Asanda, Ayanda and Dorothy